year end tax planning tips

Consider the following options for making a charitable donation. Ad 5 Best Tax Relief Companies of 2022.

8 Year End Tips To Save Tax Cbc News Business Tax Tax Services Tax Consulting

If you are already planning to.

. Home About Services Testimonials Blog. Cash basis taxpayers should consider timing of invoicing and payment for year-end income and expenses for purposes of accelerating or delaying income and deductions in. Below are some tips to potentially lower your tax bill this year.

Our Business Consultants Will Partner With You To Build Financial and Operational Success. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Comprehensive Research Platform Accurate Time-saving Tools For PlanningCompliance.

Here is a list of 10 key tax considerations for year-end tax planning for both individuals and businesses. Year-End Tax Planning Tips Take Some Tax Deductions at the Last Minute. Postpone Income and Accelerate Expenses.

Top 10 year-end tax planning tips. 6 End Of Year Tax Planning Tips For 2021 Tax-Deductible Accounts. Contact a Fidelity Advisor.

Check your paycheck withholdings. Use above-the-line charitable deduction. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Year-End Tax Planning Tips for 2021. One of our tax planning tips is to take some tax deductions at the last. At the end of the fiscal year.

The Tax Cuts and Jobs Act repealed the corporate Alternative Minimum Tax AMT and let. Here are six strategies you should use to complete tax planning for your business. Careful planning with your advisor can ensure that this strategy is used most effectively.

So ordering a laptop on December 30 that wont be delivered until January 2022 wont lower your tax liability this year. Business Year-End Tax Planning Tips and Strategies. Year-End Tax Planning Tips.

9 Wise End-of-Year Tax Planning Tips. Make HSA and 401 k. Check the background of investment professionals associated with this site on FINRAs BrokerCheck.

Consider Tax Law Changes and Traditional Strategies - Anders CPA. There may be several months left until the end of the year but it is never too early to think about end-of-year tax planning. Ad Your Life And Your Priorities Determine The Financial Strategy Thats Right For You.

The various options for tax-deductible accounts are important tools for both saving for the. Year-End Tax Planning Tips for 2021. Pay an extra mortgage payment in December and any other deductible payments.

Between the upcoming presidential election and the COVID-19 pandemic and its attendant stimulus packages this year has seen more than its. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Section 179 of the IRS tax code was created to encourage businesses to.

Year-End Tax Tips for Businesses Did you buy new equipment. Schedule a Meeting With Your Tax Advisor to Discuss End-of-year Business Tax Deductions. Here are our top 8 tips for end of year tax planning.

End Your Tax Nightmare Now. If you claim too. Ad Your Life And Your Priorities Determine The Financial Strategy Thats Right For You.

A number of tax-advantaged options are available for those wanting to make year-end contributions. Tax-loss harvesting is another strategy that could prove. In hopes of making your end to 2021 as smooth as possible we have compiled several tax-planning ideas to help alleviate the pressure of year-end planning.

Consider preparing for the upcoming tax season by taking advantage of a few important end-of-year tax strategies. Update your records and stabilize your finances Reconcile your bank and credit card accounts. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

If you want to take a coronavirus-related distribution youll need to do it before December 30 2020. Thanks to the CARES Act if youre eligible you can take a. Ad Bloomberg Tax Provides Intelligence Across All Areas of Taxation.

Build Your Future With a Firm that has 85 Years of Investment Experience. Reconciling and including all transactions from the propertys or entitys. Here are some tips to make tax planning easier so you can avoid being overwhelmed when it is time to file your taxes.

Tax Planning Tips for. Start Reaching Your Goals With The Help Of Prudential Financial Professionals Today. For those who must make Required Minimum Distributions RMDs Qualified Charitable Distributions QCDs up to 100000 per year may be used to satisfy all or a portion.

Invest in business equipment supplies and other assets. Start Reaching Your Goals With The Help Of Prudential Financial Professionals Today. As the end of 2021 approaches it is less likely each day that there will be any new legislation related to taxes passing Congress.

Adopting these strategies may reduce your tax obligations. 7 Important Year-End Tax Planning Moves to Make Before the New Year 1. Tax Tips For individuals.

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Business Tax Small Business Tax Small Business Finance

Tax Planning Services In Delhi Ncr Tax Advisory Company Delhi In 2021 How To Plan Tax Consulting Tax Preparation

Year End Tax Planning Tips For Women Professionals 2020 Edition Retirement Money Personal Finance Lessons Personal Finance Advice

Get To Know Misunderstood Business Tax Deductions Before Your Year End Planning Moneybyramey Com Business Tax Deductions Business Tax Financial Education

3 Ways To Make Small Business Tax Planning More Effective Small Business Tax Business Tax Small Business Blog

Tax Planning How To Plan Investing Budgeting Finances

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Saving Money Budget Managing Your Money Money Mindset

Year End Tax Planning Strategies And Tips Fire Book Book Burning Apple Books

Year End Tax Planning Tips For 2019 2020 Countdown Countdown Tips Tax

Tax Tip 19 Federal Income Tax Tips Sole Proprietorship

Scope Of Management Accounting Management Guru Tax Prep Checklist Small Business Tax Tax Prep

Small Business Tax Tips Smb Year End Tax Advice Startup Business Plan Startup Advice Small Business Advice

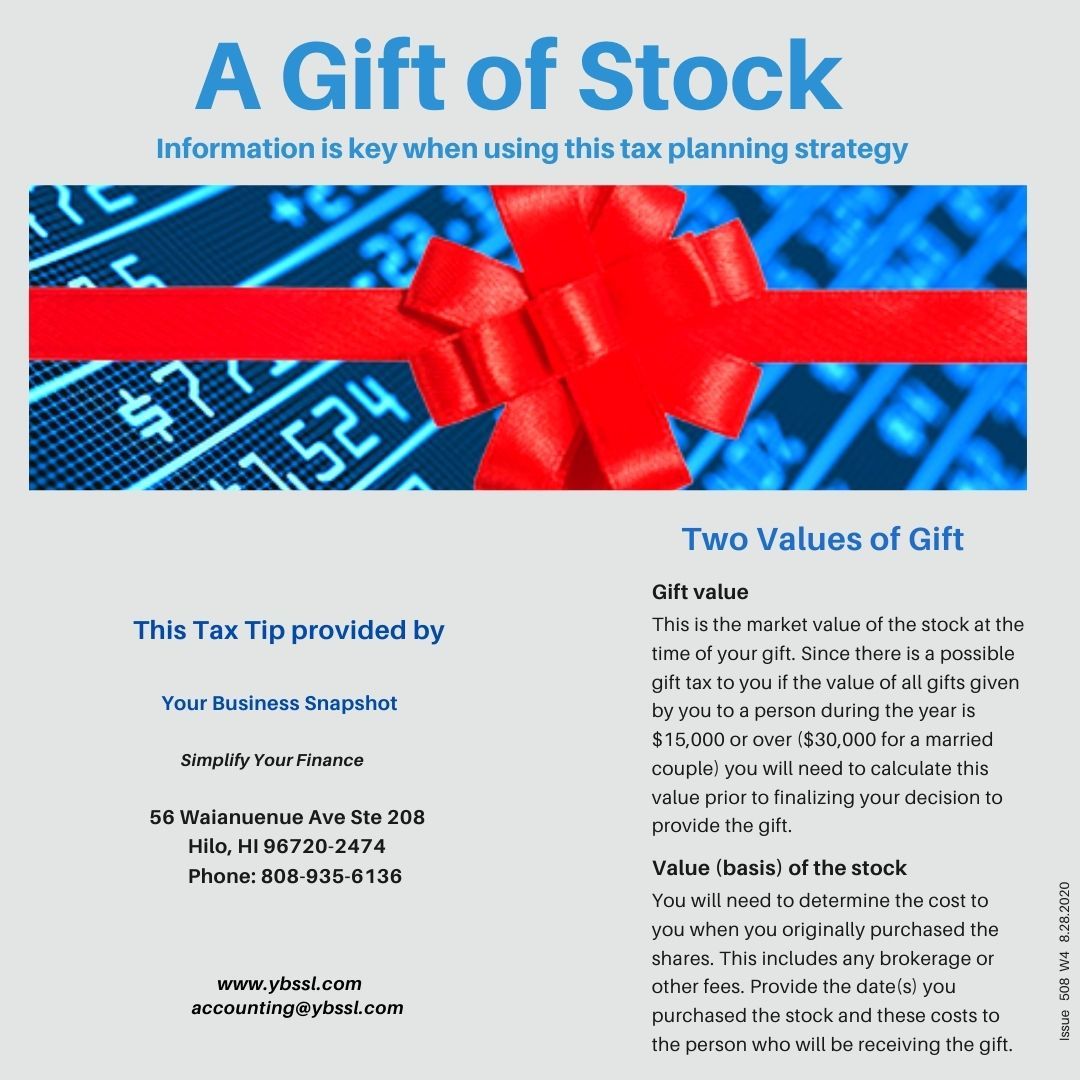

A Gift Of Stock Stock Information Gifts Stock

Three Critical Year End Tax Planning Moves Money Making Business Money Saving Tips Planning Checklist

Tips For Planning Your Year End Taxes Tax Time Tax How To Plan